Today, 08 Feburary 2017, RBI governor Mr. Urjit Patel released 6th Bimonthly Monetary Policy of the Reserve Bank of India. The economists were expecting a 25 basis point rate cut in this policy but the RBI has once again kept the repo rate unchanged. In the Last RBI fifth bimonthly policy also economists were stunned with the move. So what made RBI to further delay with the Repo rate cut? – Let’s discuss key points of the policy!!

Unchanged Repo Rate: RBI has kept the policy rate unchanged at 6.25% in order to ease the inflation arithmetic and the escalation concerns over subduing economy post demonetisation. The reverse repo rate is also unchanged at 5.75% with an unanimous decision by the MPC of the RBI.

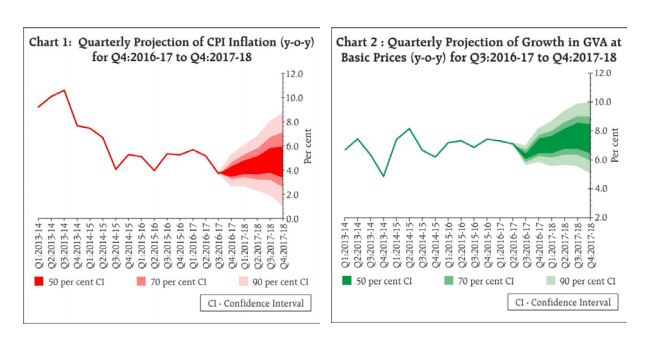

Outlook on Inflation: RBI is expecting a 4-4.5% inflation rate for the period of April to September 2017. The MPC believes that apart from food and fuel rates, Inflation will remain persistent on triggering secondary effects. Moreover CPI inflation is expected to be below 5%.

Aim for Gross Value Added: GVA growth is expected to be 7.4% for the fiscal year 2017-18 while for 2016-17, it is estimated at 6.9% which seems reasonable after the economic slow down after note ban in India. Hence RBI is expecting a sharp recovery in coming quarters. RBI is also expecting a quick recovery in retail businesses, tourism, and logistic sectors. Even banks have a lot of cash liquidity to cope up with interest and lending rates.

Unchanged CAD: RBI has also said that Current Account Deficit will remain below 1% of the Gross Domestic Product in 2016-17.

Cash Withdrawal Limit: RBI has announced that savings account holders can withdraw Rs.50,000 in a week from 20 February 2017, previously the cap was Rs.24,000 a week. And post 13 March 2017, there will be no limit on withdrawing cash.

The next RBI policy meeting will be on 05 and 06 April 2017.